We are a family run business operating in our own community. As such, our clients are our own friends and neighbors. We take great pride that they have entrusted us with their most valued assets, their home or business. A responsibility we don’t take lightly.

We use the latest technologies to investigate your loss and inspect your property. Using the same estimating software used by major insurance companies, we are fully prepared to negotiate with your insurance carrier to reach the results needed.

What we do?

Our experienced team provides the following public insurance adjustment services:

- Evaluate existing insurance policies to determine what coverage may be applicable to a claim

- Assess and document damages to buildings and contents

- Evaluate business interruption losses, loss of rent, and/or additional living expenses

- Determine a fair value to settle covered damages

- Prepare, manage, and support the claim on behalf of the insured

- Negotiate a settlement with the insurance company on behalf of the insured even when a claim has been denied or underpaid

- Re-open claims and negotiate for more money if a discrepancy is found after the claim was settled

What is a Public Adjuster?

A Public Insurance Adjuster is a licensed and bonded insurance professional who assists policyholders with the A public adjuster is an insurance claims adjuster who advocates for the policyholder in appraising and negotiating an insurance claim. A public adjuster is the only type of claims adjuster that can legally represent the rights of an insured during an insurance claim process.

What Is The Difference Between a Public Adjuster and an Insurance Company Adjuster?

The insurance company adjuster or independent claim adjuster are both employed by the insurance company and can’t protect both your interest and the interest of his/her employer at the same time. The insurance company adjuster will often offer to settle a claim for the sum they see fit, which is not always in favor of the policyholder. A public adjuster is an insurance adjuster expert who works exclusively for you, the policyholder. We are experts in reading the final print and understanding your policy, coverage, and the insurance company’s responsibilities in order to negotiate a better settlement.

TYPES OF CLAIMS

FIRE DAMAGE

WATER DAMAGE

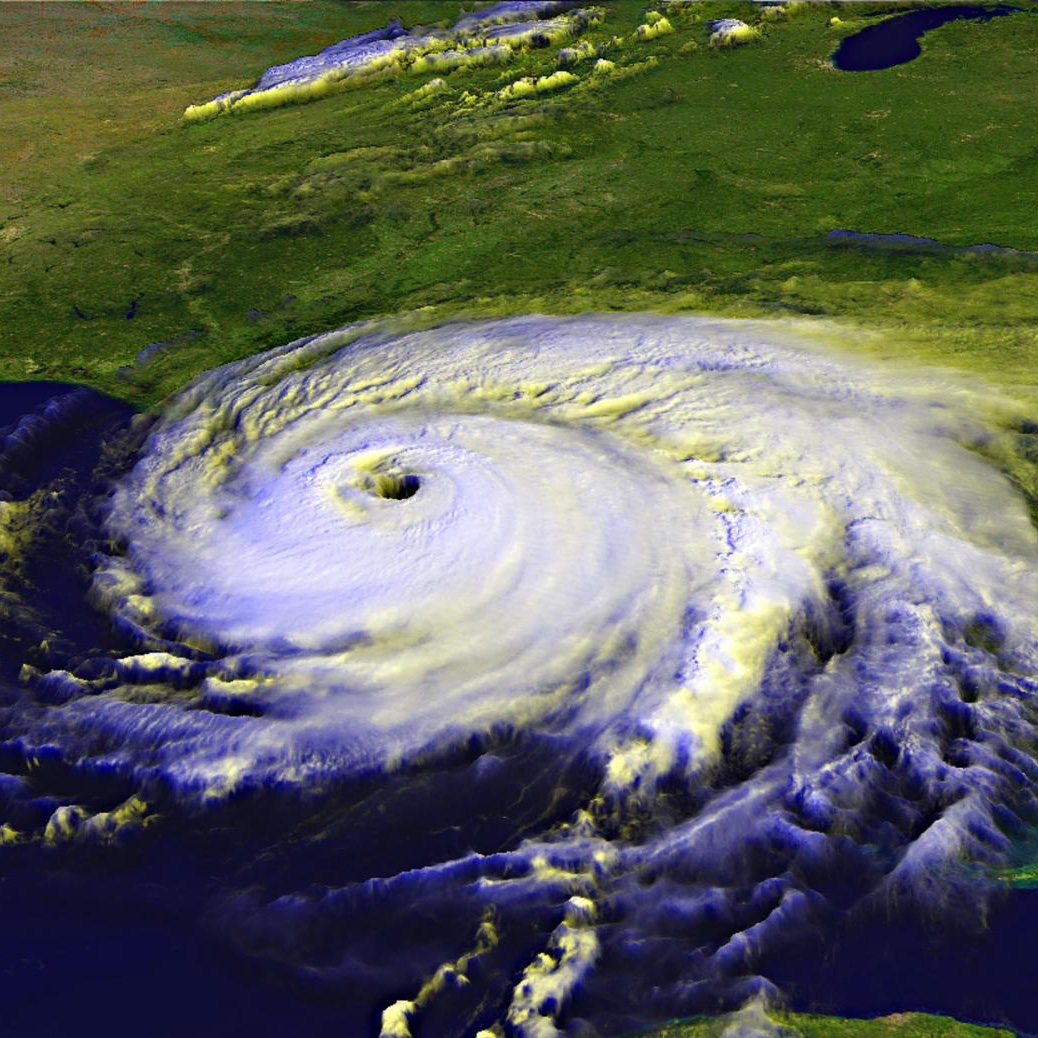

STORM DAMAGE

TORNADO DAMAGE

ROOF DAMAGE

HURRICANE DAMAGE

COLLAPSE

FLOOD DAMAGE